“Location, Location… Timing!”

One of the greatest lies in real-estate investment is the adage “Location, Location, Location.”

While I agree with the first two words, I would strongly encourage changing the third to “Timing.”

Real Estate cycles are as normal as seasons. Prices ramp up and then they crash. It’s a “Buyer’s” market—then it’s a “Seller’s.” The good news is: Those who can recognize these market fluctuations are more likely to “Buy Low and Sell High” as the market ebbs and flows. Therefore, understanding “Timing” can be even more profitable than choosing the right “Location.”

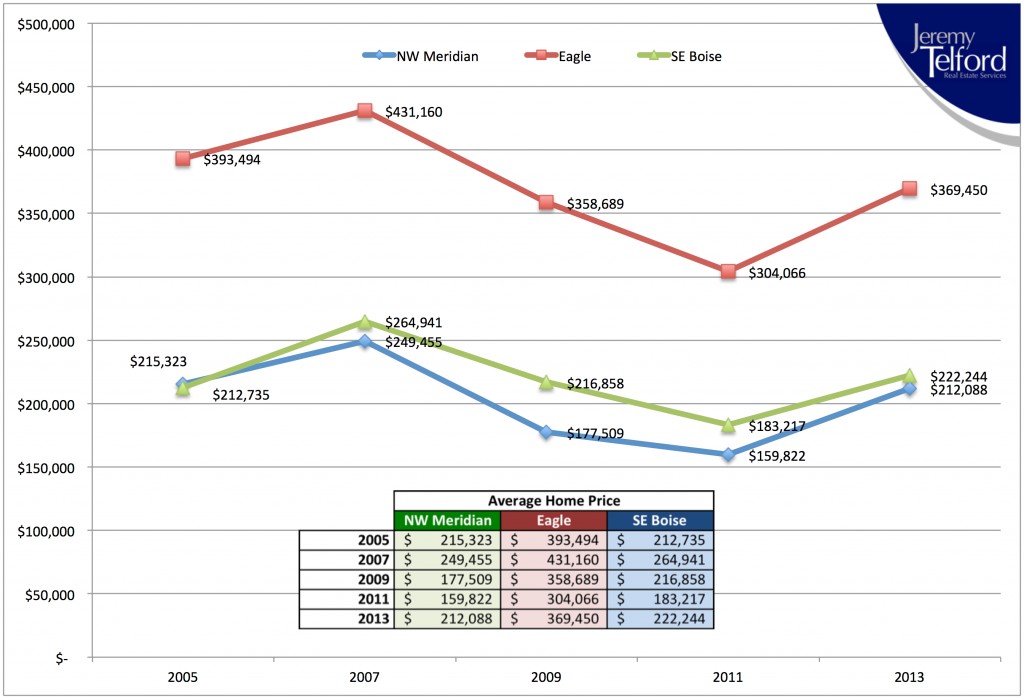

Case in-point, let’s look at the data of the homes sales in NW Meridian, Eagle and SE Boise during the last real estate cycle—2005 to 2013. Average home prices in these three markets rose by +16% (NW Meridian), +10% (Eagle) and +25% between 2005 and 2007. Then, from 2007 to 2009 they dropped by -29%, -17% and -18%, respectively. From 2009 to 2011, prices slid another -10%, -15%, and -16% before going back up from 2011 to 2013 by +33%, +22% and +21%, respectively.

What does this show us? Look at it this way…

If you had purchased an AVERAGE home in NW Meridian in 2005 ($215,000) and sold it in 2007 ($250,000), you would have made about $35,000. That is a 16% ROI if you paid cash or over a 100% ROI if you mortgaged the property. Well done!

However, if you bought that same house (in the same “Location”) in 2007 ($250,000) and sold it in 2009 ($177,500) you would have lost $72,500. Yikes! And, if you had held it until 2011 ($160,000), you would have LOST $90,000+ (CASH) in a 4-year period. That’s nearly 40% of the total purchase price of the home just because of “Timing.”

These trends are easy to see in hindsight, but more difficult to predict in advance. While there are certain indicators that can foreshadow when the next peak (and subsequent crash) will occur, no one can pinpoint the month & day until it’s too late.

By taking an educated / quantitative approach to short-term investing, however, you can always hedge against taking a bath on a home purchase. You can also—quite easily—ensure you are getting the most out of your home by being willing to sell during a “Seller’s” market.

Wondering when the best time for your next real-estate investment (or liquidation) will be? Give us a call. We’d be happy to talk you through it.

All the best,

Jeremy

Click here to Search the MLS

Click here to Find Out What Your Home is Worth

Click here for Samples of the Quality of Photography We Provide